In today’s global digital wave, intelligent and compliant tax and finance management has become a core issue for multinational enterprises to improve operational efficiency and reduce risks. With the comprehensive rollout of China’s Golden Tax Phase IV and the advent of the digital electronic invoice era, traditional tax and finance management models are undergoing profound transformation. Beijing Kailing Technology Co., Ltd., a professional, efficient, and reliable provider of enterprise digital tax and finance solutions, recently successfully supported a large multinational group in fully launching its “Natural System Direct Connection” tax-finance integration project, injecting strong momentum into its compliant operations and digital transformation in the Chinese market.

A New Era of Direct Connection: Natural System Reshapes Enterprise Tax-Finance Ecology

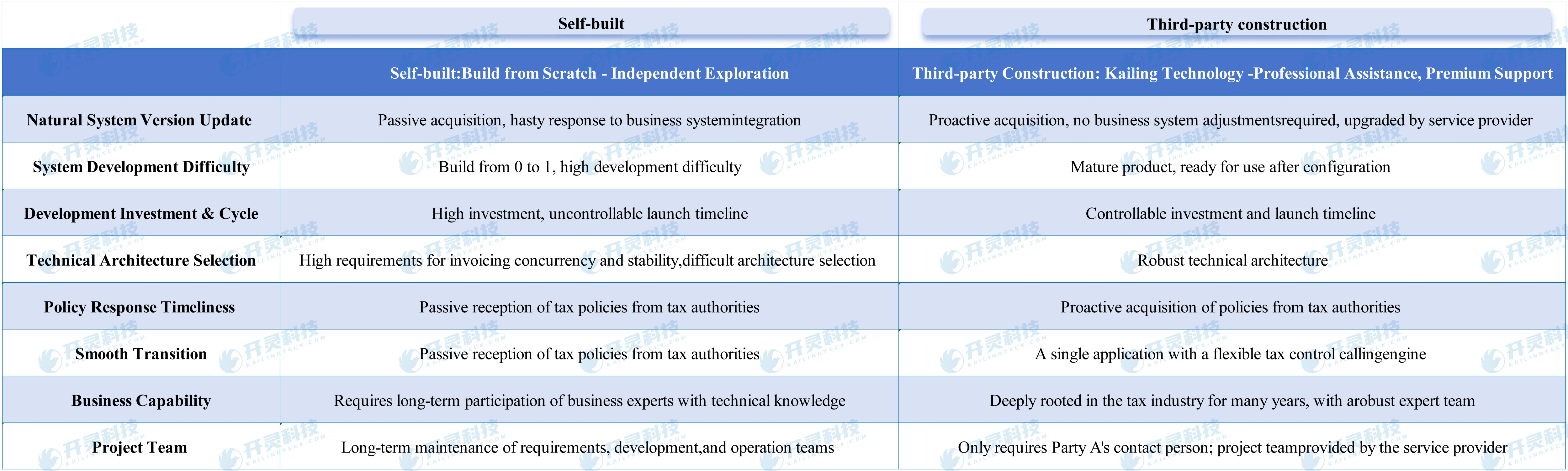

Natural System is a platform opened by the State Taxation Administration to qualified enterprises for direct connection between their own information systems and the tax system. Through the dual-open model of “rules + data,” enterprises can embed the entire process of invoice issuance, receipt, collection, and authentication into their own business systems, achieving the integration of “business, finance, and taxation.” However, Natural System direct connection involves complex interface development, process redesign, data validation, and compliance adaptation, posing high requirements for enterprises’ technical capabilities and tax understanding.

Kailing Technology’s One-Stop Solution: Professional Delivery, End-to-End Support

Leveraging deep industry expertise and advanced technical integration capabilities, Kailing Technology provides multinational groups with a “turnkey solution” covering consulting, system development, testing, launch, and ongoing maintenance. The solution highlights the following core advantages:

jrhz.info

1. End-to-End Service Support

Provides services including Natural System application documentation preparation, tax authority communication and coordination, and sandbox testing support. Enterprises only need to cooperate with stamping and confirmation, significantly shortening the launch cycle.

2. High-Performance System Architecture and Natural System Interface Encapsulation

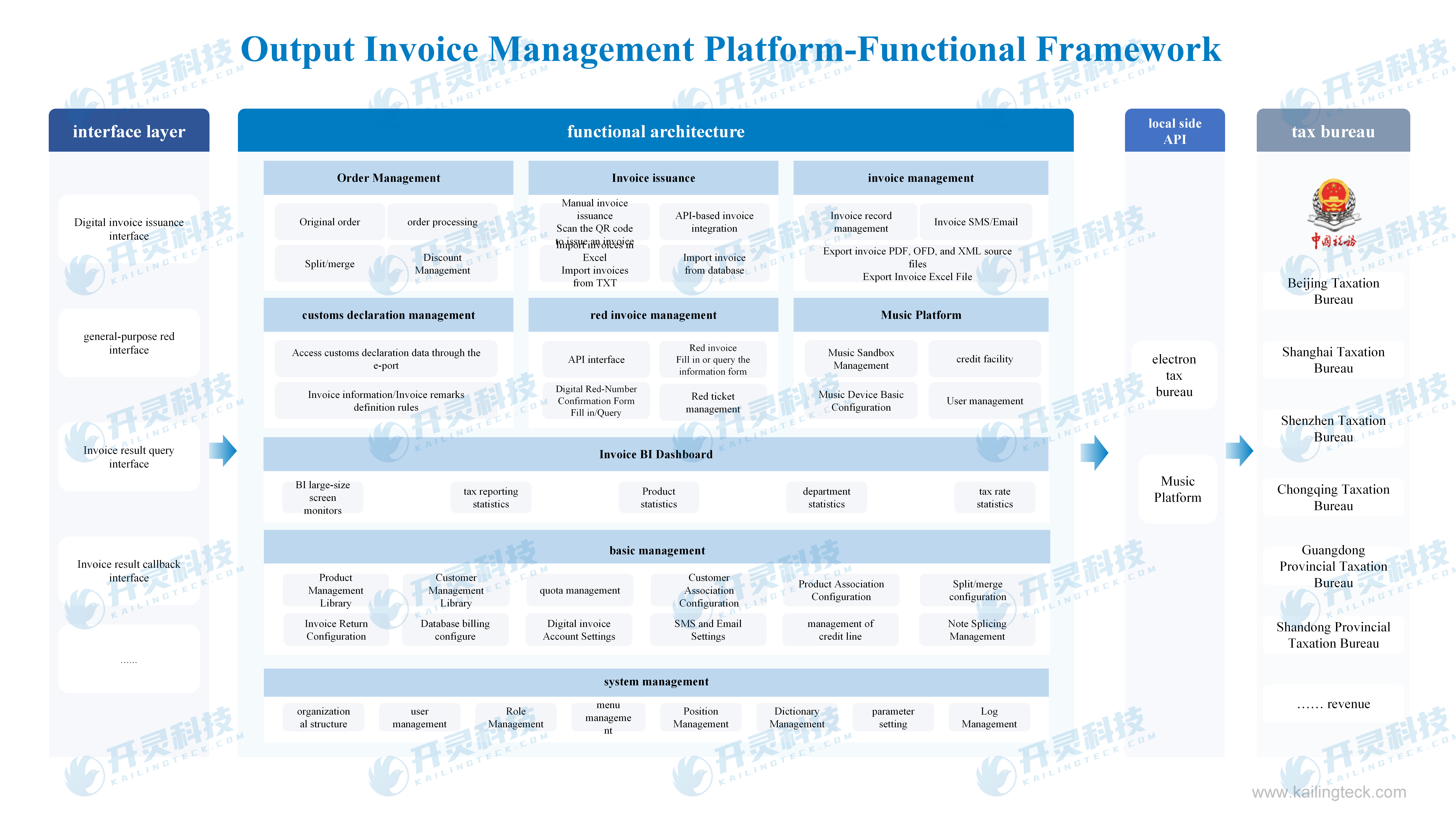

The system supports automated invoice issuance, red reversal, splitting and merging, and format synthesis for multiple business scenarios. It encapsulates the native Natural System interfaces into user-friendly business interfaces, greatly reducing development and integration complexity.

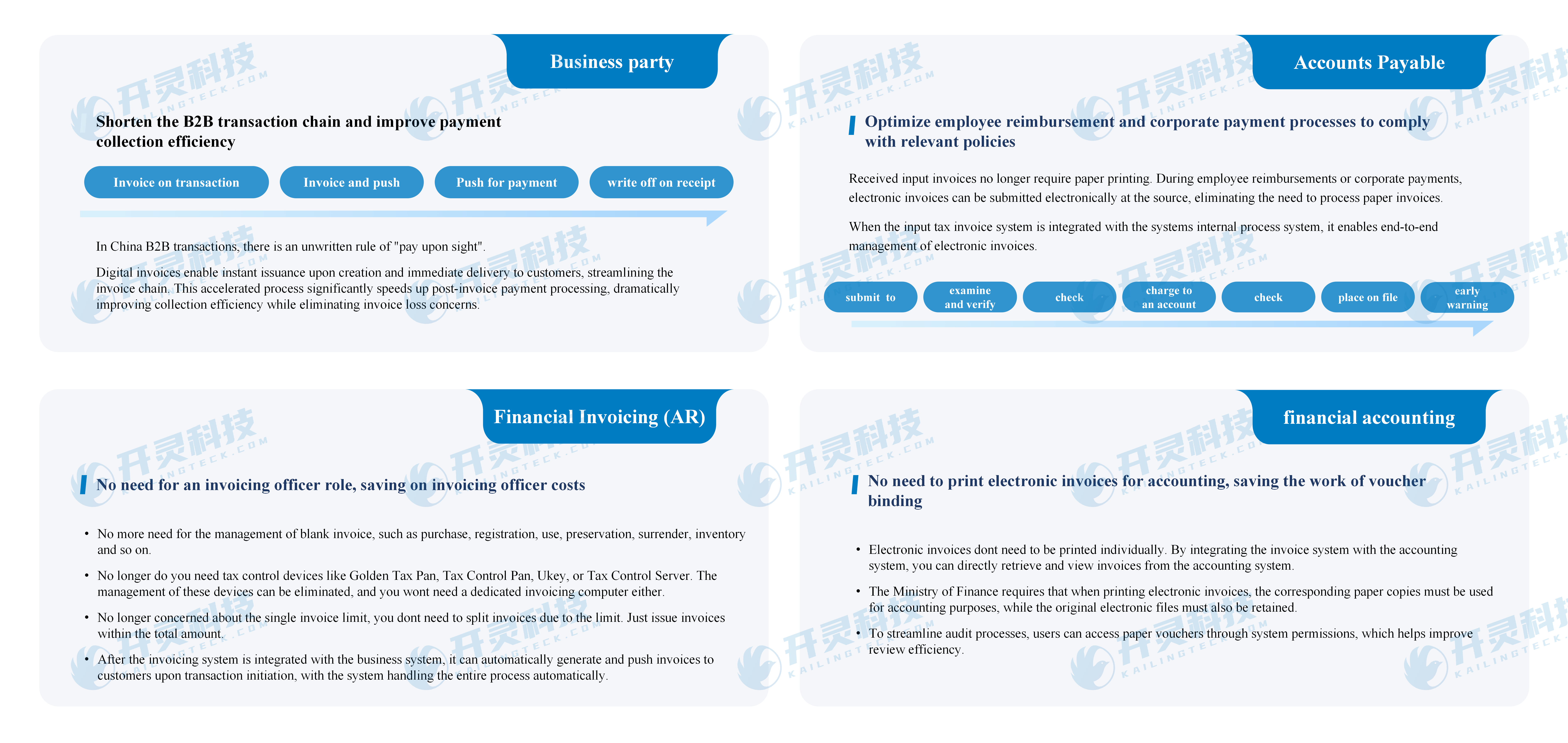

3. Group-Level Tax-Finance Integration Management

Supports unified management of multiple companies and tax IDs, enabling seamless integration with mainstream ERP and OA systems such as SAP, Oracle, Yonyou, and Kingdee. It automates the entire chain from sales, procurement, and reimbursement to accounting and archiving.

4. Autonomous and Controllable Technology Delivery

Adopts a full source code delivery and copyright transfer model, ensuring enterprises fully own the system and retain technical autonomy, complying with the State Taxation Administration’s requirement that Natural System systems “shall not be hosted by third parties.”

Creating Sustainable Value: Efficiency Improvement, Risk Control, and Intelligent Decision-Making

After the project launch, the enterprise achieved:

- Fully Automated Invoicing: Invoices issued upon business triggering, delivered to customers in real time, significantly improving payment collection efficiency.

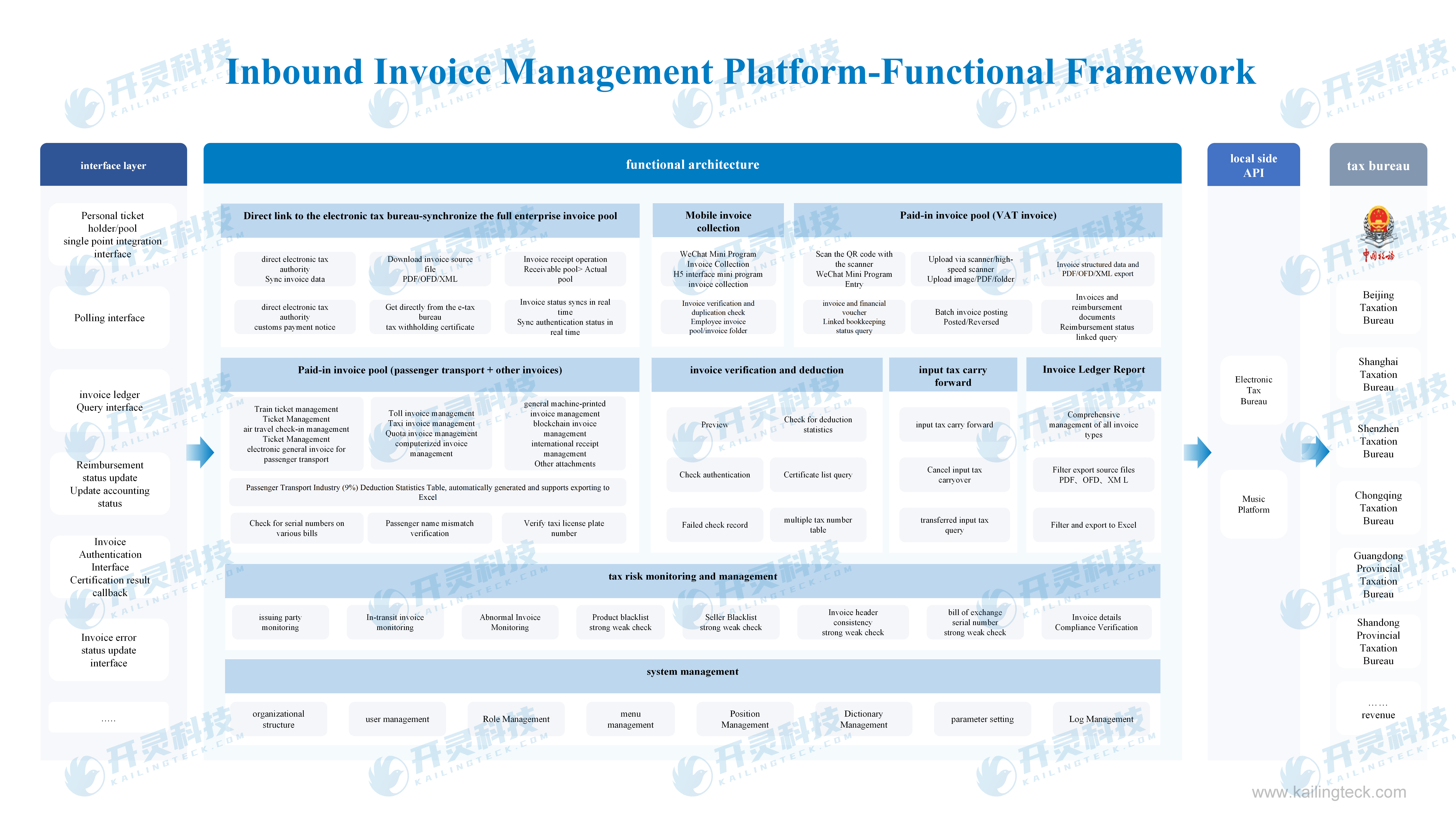

- Intelligent Input Invoice Management: Supports multi-channel invoice collection, automatic authenticity verification, duplicate checking, and one-click authentication, enabling full input tax credit utilization.

- Compliance Assurance: Built-in risk control rules enable real-time monitoring of invoice status and supplier risks, preventing tax non-compliance.

- Electronic Archiving: Fully preserves source files of digital electronic invoices, complying with the Ministry of Finance’s electronic accounting archive management requirements.

Partner with Kailing to Step into a Smarter Tax-Finance Future

Kailing Technology adheres to the service philosophy of “Professional, Efficient, Reliable” and has served numerous Fortune 500 and industry-leading enterprises. Moving forward, we will continue to deepen our expertise in digital tax and finance, helping more multinational enterprises achieve compliant, efficient, and intelligent tax-finance management upgrades in the Chinese market.

If you are planning or advancing a Natural System direct connection or digital tax-finance project, please contact Kailing Technology for customized solutions and professional consultation.

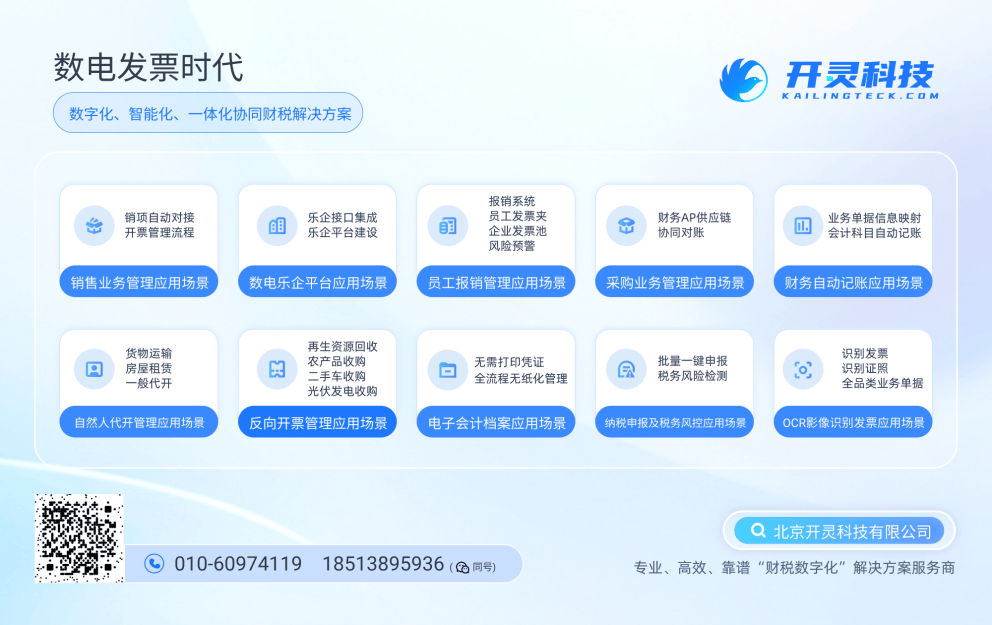

Kailing Technology, as a comprehensive digital solutions provider for finance and taxation, delivers digital transformation products and operational services for financial and tax management to government agencies, institutions, and enterprises of all sizes. Our product portfolio includes:

Sales Contract Management System, Procurement Contract Management System, Natural System Project, Automatic Sales Invoice System, Reverse Invoice System, Individual Invoice System, Employee Expense Control & Reimbursement System, Input Invoice Management System, Supply Chain Collaborative Reconciliation System, Image OCR Recognition System, Automated Financial Accounting System, Electronic Accounting Archives System, and other business solutions that comprehensively advance digitalization across all sectors.

For any financial and tax digital transformation needs, please contact us. Beijing Kailing Technology is dedicated to serving you.